As Insurers continue to push forward on IFRS 17 projects, the discussion has shifted in part to post SII and IFRS 17 Key Performance Indicators (KPIs). The topic has been taken up by the CFO Forum in the form of a working group and recently, Aptitude Software Senior Presales Consultant and IFRS 17 Expert, Brian Heale, took part in a panel session on the expected changes to established KPIs as a result of the standard and the new KPIs that will need to be introduced in the post-IFRS 17 world.

While there has been little industry consensus or alignment on what the key KPIs should be going forward, it is widely accepted that there will be differences between Life and GI/P&C Insurers as well as between the with-profit and annuity books of business.

IFRS 17 fundamentally changes the way profit emerges but also brings with it a new set of disclosures and reporting at a much higher level of granularity. Thus, it is important to explain the disclosures from a business performance versus a technical perspective. The management KPIs need to back up that messaging and it will also be necessary to take the shareholders and analysts through the journey.

Existing differences and inconsistencies

There are already differences in which KPIs are measured and tracked among insurers. Although industry professionals hope IFRS 17 will bring some consistency across the industry, most believe that these inconsistencies will continue to some degree, especially considering the interpretive nature of the standard. For example, Life Insurers will continue to measure Adjusted Operating Profit (AoP) while General and P&C insurers will continue focusing on Combined Operating Ratio (CoR).

Even for relatively established KPIs, insurers tend to calculate them in slightly different ways further affecting industry consistency. Industry alignment and consistency will take time and there may be short-term confusion in comparisons. It will take several years at least – many insurers are still changing their SII KPIs!

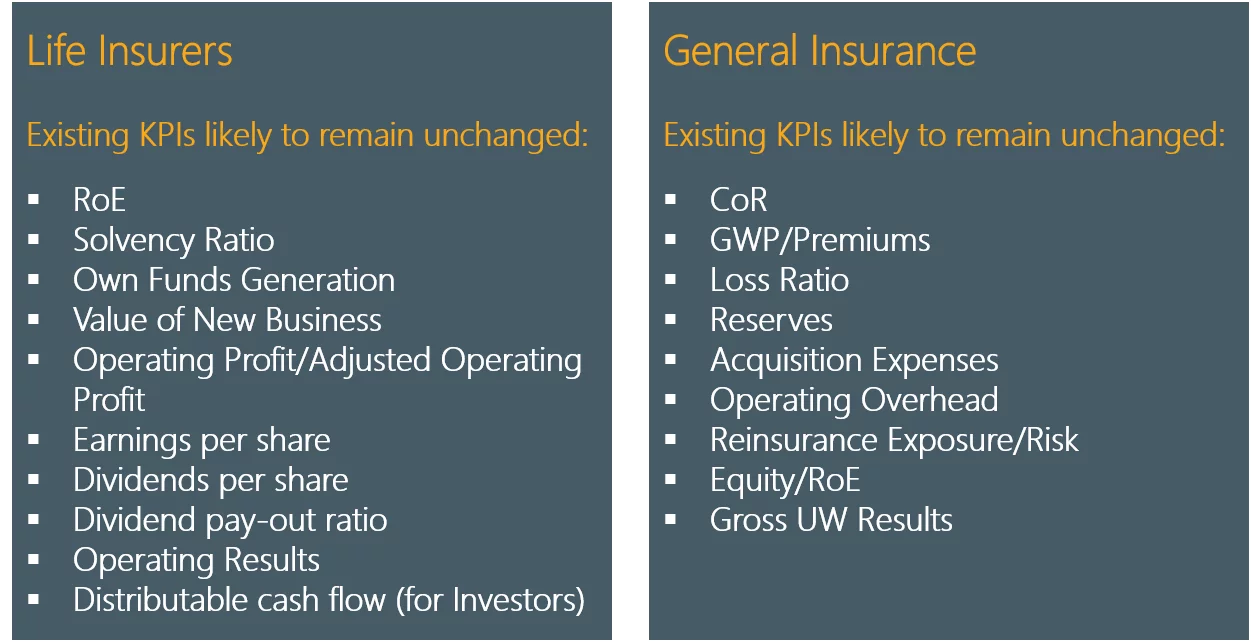

The chart below illustrates the current alignment of KPIs by insurer type. While these existing KPIs will remain relevant, Insurers will likely see changes to the figures as well as increased volatility once reporting under the new standard begins.

New KPIs resulting from the standard

The CFO Forum has been instrumental in guiding the development of IFRS 17 and one of the recent topics covered are the new KPI’s in the insurance market post-SII/IFRS 17.

Many believe that while existing KPIs will remain, new, IFRS 17-specific KPIs will need to be added. This is because Insurers will be interested in the impact IFRS 17 will have on a raft of factors such as the ability to pay dividends, profit emergence, and reinsurance arrangements.

Many Insurers have communicated that they are waiting to see what action their peers take before trying to define new KPIs. This likely means that complete industry alignment and consistency will take time and there may be short-term confusion in comparisons as the industry settles into the new reporting standard.

In addition to new KPIs, Insurers will also need to develop a detailed Analysis of Change for Net Assets/IFRS 17/SII for management information purposes.

KPIs and Metrics for Life Insurers

CSM and CSM + Net Asset Value (NAV)

The CSM (and CSM + NAV) will become a major balance sheet profit metric moving forward as it aligns with an own funds perspective and looking at the two together helps to understand balance sheet metrics such as gearing. For IFRS 17, the CSM and the release of the CSM will become a key profit metric in addition to the (AoP). The CFO Forum has noted that the CSM metric will vary between GMM and VFA measured business.

A key aspect of the CSM is the shape of the profit emergence (flowing to the income statement) over time. The CSM can be set in different ways depending on the needs of the business. Basically, an insurer can have a large CSM that spreads profit or a smaller CSM which releases profit. However, the larger the CSM the lower the net assets and the bigger the impact on distributable profits. A few points on the CSM:

- Acts as a store of value and makes growth profiles clearer.

- Can be considered a type of Operating profit.

- Useful to show from a new, recurring, and run-off business perspective.

- Relates to life business only with investment contracts measured under IFRS 9

If the CSM release – and therefore the profits – in future periods are high, that does not ensure they will remain high and will decrease unless the new business’ profitability is good. This means if investors and analysts prefer a sustainable (and non-decreasing) dividend stream, high profits in the near futures produced using some “freedom of design” under IFRS 17 could evoke unfavorable expectations if the CSM release cannot be compensated by new business.

Adjusted Operating Profit

AoP is an important key performance indicator for life insurers and there are discussions around what elements should be included in the AoP as adjustments are likely to be needed and those adjustments are likely to be more complex under IFRS 17.

Generally, insurers look to smooth their AoP but other factors need to be considered:

- Do you exclude mismatches?

- Do you take out short-term market movements caused by market fluctuations and economic variances?

- Do you include management actions?

- Do you show real-world investment returns for with-profit businesses as opposed to risk-free rate returns?

Insurance Revenue

Insurance Revenue might be considered as an additional metric to measure business volume and growth.

However, challenges could include identifying the meaning of an increase or decrease, measuring new business, and explaining differences between insurance revenue and gross written premiums or new business premiums.

KPIs and Metrics for General Insurers

Combined Operating Ratio (CoR)

Virtually all the GI insurers will adopt the PAA methodology but CoR will remain a cornerstone metric as it is so well established across the industry. However, inputs to COR driven by IFRS 17 like discounting long-term claims, onerous contracts, and the risk adjustment will change the measure significantly. General Insurers will likely move to CoR reported on a net basis and reinsurance reported on a gross basis. There will, of course, be new disclosures and the extra dimensions of payment patterns and interest rate development to consider as well as changes to the way expenses are presented in the P&L.

Gross Written Premiums

GWP (a current GI metric) in the Standard will be replaced by Insurance Contract Revenue. However, many GI insurers will continue to report GWP (adjusted for IFRS 17) voluntarily as a growth metric.

Gross UW Results

Gross UW results will be included under IFRS 17. Also, the underwriting results, a part of CoR, will need to be adjusted for which costs go into attributable (e.g. claims handling) and non-attributable expenses – this will be an interpretation. This may reduce the CoR, but expenses will be the same and Insurers will need to understand the cost allocation between peers. This is complicated by the fact that the Standard does not give a clear definition of attributable costs, and this can significantly change some of the IFRS 17 calculations. It will also drive the measurement of onerous contracts as currently there is no distinction between the two types of costs.

Moving Forward

Conversations will continue over the coming months as to the changes required to existing KPIs and new KPIs that must be considered under the new standard. To share your thoughts or discuss this in more detail, please reach out to me at brian.heale@aptitudesoftware.com.