Early this year, Aptitude welcomed Nick Shah as Head of CFO Business Architecture. He brings over 20 years of experience in financial services and spent the last decade with HSBC, most recently leading their Finance Cloud Transformation Programme. Based out of the Aptitude London office, he recently shared his perspectives on the shifting role of the finance department, the benefits of a digital finance transformation and why he sees Aptitude as an exciting next chapter.

Watch Nick’s recent roundtable

Sarah: Welcome, Nick! We’re so excited to have you at Aptitude. I have to say, when I read your background and saw your new title – actually a brand-new position for Aptitude – it made perfect sense given your experience. What jumped out to you about the role?

Nick: Thank you! So, the thing that appealed to me most was the journey that Aptitude are looking to embark on. It’s a company that has history. It’s got a very good reputation in the market in terms of the software and the solutions it provides. And it also has this reputation as a company that understands the finance business problems that real-world organizations are actually trying to solve.

That alone is great, but I was also interested in the vision that Aptitude has set out for what’s coming next. The team here has a very good understanding of the capabilities needed to really transform a finance function, coupled with the opportunity to take my learnings and experience from HSBC, and apply it to my role at Aptitude was intriguing. Perhaps most importantly, as an Aptitude client in my previous role, I knew I could walk the talk so to speak.

Sarah: That’s great. And I think you bring such a unique perspective in that you have really been living and breathing this reality for finance departments as they work to shift not just their architecture or business processes, but really their whole mission and vision for the function.

Nick: Yes, I think that’s right. Finance departments must really focus on the business decision support aspect of their role, whilst also maintaining the robust regulatory compliance and control portion of the function. A Finance transformation programme cannot be limited to utilising new and evolving technologies, it must focus on redefining the Finance operating model, the finance business processes and controls, as well as the underlying data and system solutions.

The challenge most large banks have faced is that over the years, investment in Finance data and technology has been closely coupled with the constant stream of regulatory requirements, often resulting in solutions or processes being bolted on to existing solutions, resulting in siloed data flows, process and systems. With the benefits of Cloud technology, there is now a real opportunity to go back and rethink how a Finance function can operate a more holistic end to end function, with digital capabilities.

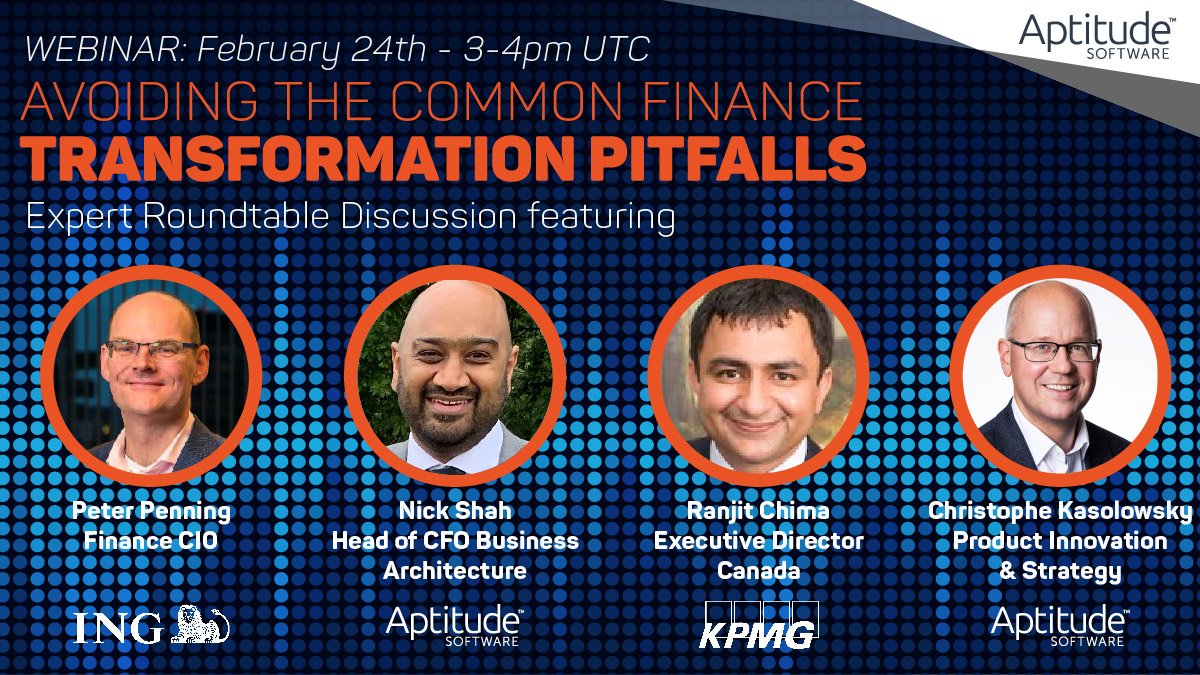

Sarah: We’re looking forward to having you speak about your experience leading Finance transformation programmes on our upcoming webinar around digital finance change alongside ING Finance CIO, Peter Penning and KPMG Executive Director, Ranjit Chima. Can you talk a bit about your Finance transformation experience?

Nick: Yes, I’m looking forward to the webinar! The transformation journey for me started with seeing the technology and performance improvements that came with maturing cloud solutions and being able to successfully prove a single use case on the new technologies. The success of a first implementation then provided the confidence required to use the advancement in technology to enable the business to transform the way it operates, and to move finance from being a reporting and control focussed function to being a function that was there to help with business decisions and advisory support.

Transformation in any organization is complex and I’ll save my war stories for the webinar, but a critical enabler for transformation is a clear data strategy, ensuring the availability of granular data, sourced on a timely and consistent basis from approved sources. A key question for a Finance transformation programme to answer is ‘How do we build an architecture that prevents us from having different teams within Finance using different data sets and getting a different answer each time?’

Sarah: Excellent, looking forward to hearing more. Another question – do you think underinvestment in finance systems and technology over the years is the reason for the explosion in digital finance transformations we see today?

Nick: I personally don’t like to look at it as historic underinvestment. I think the investments that have been made in Finance data and systems were necessitated by the Finance priorities at that moment in time. And the reality is, based on my experience in Financial Services over the past couple of decades, that’s been driven by mandatory regulatory change.

My career actually started off on a regulatory change project implementing Risk Weighted Asset calculations in the early 2000s under the Basel 2 rules. This was the first regulatory initiative that really required Finance to have access to granular data to enable the calculations. Those regulations forced Finance functions to invest in implementing data warehouse technologies, as well as integrate finance and risk data for the first time to meet the regulatory requirements within the tight regulatory deadlines. I wouldn’t say that was underinvestment, however, it certainly didn’t focus on implementing the broader business outcomes possible from access to a granular data repository.

That trend has continued through the years with additional regulatory requirements related to liquidity reporting, stress testing, followed by key accounting rules packages (IFRS9, 15, 16, 17) These initiatives have required significant investment to ensure the regulatory objectives. Now we see the role of the finance function evolve and they are not able to rely on the architecture and the data that had been put in place for regulatory compliance to achieve these broader objectives of finance – and hence the need to invest now in the Finance transformation capabilities.

Sarah: All right, last question before I let you go. If CFOs could only focus on one change area, where would you direct their attention? What’s the biggest bang for your buck as you think about a finance transformation?

Nick: The area for me would be to invest in ensuring the underlying data strategy and sourcing is in place. Without having that foundation that underpins every single finance use case, it’s very difficult to meet future requirements whether they are regulatory requirements, internal requirements, or better analytics. The strength of a Finance function today is in the controlled and auditable nature of the books and records, which reside in the subledger and general ledgers. It is essential to leverage these existing capabilities within their implementation strategies to fully maximize the opportunities possible from a successful transformation programme.

Sarah: Thank you, Nick! Looking forward to hearing more from you on February 24th.