Over the years, technological advances have pushed the finance function forward, moving it from manual, paper-based processes to a function powered by cloud computing, data analysis and increased automation.

These technologies have enabled finance professionals to automate repetitive tasks, improve accuracy and gain deeper insights from data, allowing them to focus more on strategic decision making and adding value to the business.

However, with the maturation of cloud and cognitive computing tools and the adoption of AI in the finance function picking up speed over the last 12 months, a new phase is emerging which has been coined by Gartner as Autonomous Finance.

Defining Autonomous Finance

There are variations of the definition of Autonomous Finance but at Aptitude, we believe an Autonomous Finance function is one where:

- Systems are self-learning, self-improving, efficient and interoperable

- Tasks are optimized and intelligent

- An enterprise-wide data platform supports real-time insights, enabling finance to be a strategic and trusted advisor to the business

In a 2022 survey, Gartner found that, while 64% of CFOs believe autonomous finance will become a reality by 2028, few are making progress toward it.1

To better understand where CFOs and their teams are in their journey to Autonomous Finance – and if it’s a journey they want to be on – Aptitude, supported by Microsoft and HSO, commissioned third-party research that surveyed CFOs and finance professionals across the globe. The focus was on understanding current priorities, the role of Autonomous Finance & AI and where finance teams fell along a continuum ranging from traditional to autonomous finance.

Through qualitative and quantitative research, several key themes started to emerge.

Research methodology

We used a third-party to conduct a survey of over 1,700 finance professionals and CFOs across nine geographies and six sectors. All respondents worked for organizations with revenues greater than £250 million GBP and self-reported as decision makers within their organization.

10 qualitative interviews with global CFOs were also held to get a deeper understanding of key themes and trends.

Geographies: ANZ, Benelux, Canada, DACH, Hong Kong, US, Scandinavia, Singapore and UK

Sectors: Banking, Insurance, Platforms/Tech, Manufacturing, Media, CPG/Retail

Emerging themes

Finance teams want to strategically support the broader organization and see technology as a way forward

When asked what they wanted to spend less or more time on, finance professionals reported a desire to spend less time on ad-hoc internal requests, accounting and compliance and more time on strategic planning for their function/organization and data.

One surveyed CFO from a Global Assurance Organization commented, “Autonomous finance has vast implications for a finance team. This is a technological opportunity which actually could fundamentally change the landscape of what a finance function looks like. If I were to describe it to someone it would be real-time, touchless accounting. That means that the finance function becomes an insight and decision-driving function and not an accounting function.”

When it comes to achieving that shift, a strong percentage of those surveyed believe that technology is essential for efficiency and innovation (51%) or helpful (32%) in optimizing financial processes, reporting and opportunities within their organizations. When asked whether they preferred a single stack or best-of-breed approach to procuring financial software, only 25 % responded that a single stack technology strategy is their preferred approach.

Finance is still a long way from automating core processes

The research also explored where organizations were in automating core processes. The answer is that there is clearly still work to do. The survey data showed that:

- 61% are still processing data weekly or monthly

- Only 13% have access to real-time data

- 50% have minimal or no self-service reporting

- The number one priority for finance teams working toward autonomous finance is to ‘Automate process controls, accounting and close’

Data is a top challenge…and a top opportunity

In both the qualitative discussions and quantitative surveys, data came up as both a challenge for organizations and an area in which finance teams saw significant potential.

Data quality and reliability (44%) emerged as the primary obstacle to using financial data and analytics to make strategic decisions, followed by budget constraints for investing in analytics solutions (36%) and skills and training (36%).

During the qualitative portion of the research, one CFO summed up the data challenge stating, “Today, it takes a huge variety of different types of analytics to get at the core drivers, to understand what we need to do and make sure we don’t extract the wrong thing. We have to spend so much time just wrestling the data to the ground to generate these reports.”

In addition to seeing data as a top challenge, however, it was also identified as the area where respondents felt their organizations would see the greatest ROI in the next 3-5 years when it comes to digital transformation.

CFOs who can create a detailed, real-time data foundation that is accessible to the rest of the business can create a significant strategic advantage for their organization.

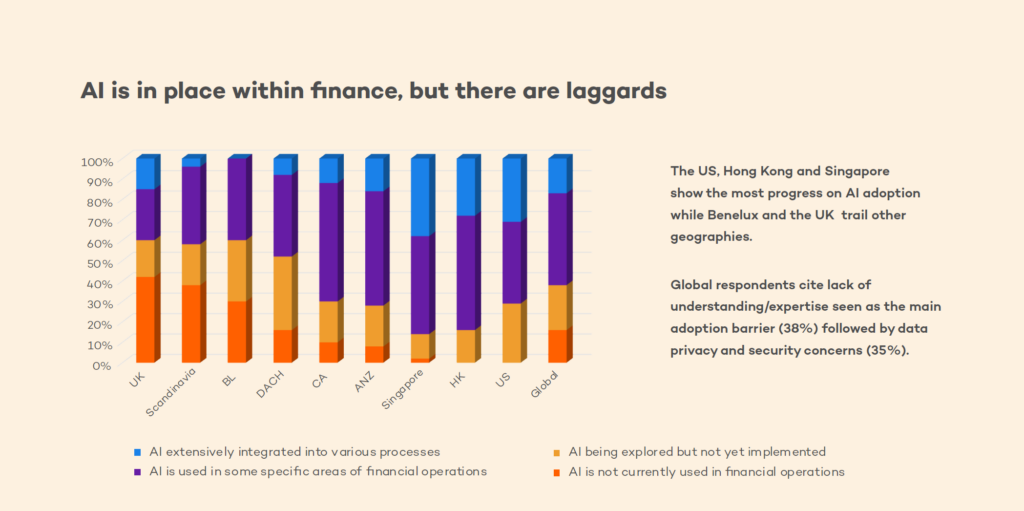

AI is in place within finance but there are laggards

Globally, 62% of respondents reported that AI is either extensively integrated into various financial processes (17%) or used in some specific areas of financial operations (45%). Digging into the surveyed sectors and regions shows which countries are lagging or leading in AI usage.

For instance, in terms of AI usage, Benelux and the UK trail other surveyed countries with 42% of UK respondents and 30% of Benelux respondents reporting that AI is not currently utilized in Finance, compared to the global average of 16%.

AI leaders include the US and Singapore with 31% of US respondents and 38% of Singaporean respondents reporting that AI is extensively integrated into various financial processes, compared to the global average 17%.

When it comes to industries, Banking had the highest number of respondents, 75%, report that AI is either extensively integrated into various financial processes or used in some specific areas of financial operations. Insurance had the lowest reported percentage at these two stages at 50%.

The why behind AI

In addition to wanting to understand the percentage of finance teams exploring AI, we also wanted to understand the areas in which they saw the most value.

Topping the list of AI benefits was improved efficiency (52%) followed by better accuracy (44%) and advanced data insights (37%).

What wasn’t top of the list? Reduction in headcount which was tied for the lowest ranked in the list of nine benefits. Perhaps this indicates that most finance professionals see AI, not as a replacement for humans, but as a partner and copilot.

One interviewed CFO noted “The future of finance functions lies in achieving a higher degree of automation and autonomy, where routing processes are streamlined and decision-making is supported by predictive analytics. However, the human element remains vital for strategic thinking and managing complex business scenarios that require nuanced judgment.”

What do CFOs need to achieve Autonomous Finance?

Autonomous Finance is a strategic and competitive advantage for an organization, freeing finance professionals from low value and manual repetitive tasks and transforming the CFO office into a strategic contributor and business enabler.

Aptitude and Microsoft recently released a joint vision for Autonomous Finance and posited that, to achieve it, a CFO needs four foundational elements in place:

- A single and accessible view of all business data

- A fully interoperable finance technology stack capable of processing large volumes at the pace of business

- Advanced AI capabilities to drive insights from data

- A finance architecture to automate manual process and the application of accounting policies

We believe the combination of Aptitude Fynapse, Dynamics 365 Finance and Supply Chain Management applications, Copilot for Finance and the Azure ecosystem can power Autonomous Finance. This collective proposition delivers a truly unique and differentiated offering in the ERP market.

We’d love to share more details about our research and demonstrate our joint Fynapse and Dynamics 365 solution! Please reach out to book a demo to see it in action.

Previously published in CFO Futures: An Autonomous Finance Magazine (Spring 2024)